Kiwi exporters cautiously optimistic about 2020 in light of trade uncertainty

Escalating trade tensions continue to cast a pall over the ailing global economy, with the International Monetary Fund (IMF) delivering the latest blow.

In the global lender’s October 2019 World Economic Outlook, the forecast for global growth this year was downgraded to 3 percent from 3.6 percent last year — the worst result on record since the 2008 financial crisis.

Yet, while most advanced economies are grappling with the effects of the trade war, New Zealand’s economy has proved resilient, even outperforming its peers in the region.

“The New Zealand economy is in good shape. We have a lot to be positive about, and we should be careful not to talk ourselves into a downturn,” said New Zealand Finance Minister Grant Robertson in a government statement.

The positive sentiment is also shared by the country’s exporters who — despite seeing exports soften slightly in the past 12 months — remain largely optimistic of export activity in 2020, going by results from the 2019 ExportNZ DHL Export Barometer.

So what are the challenges ahead for the country’s exporters, and how are they looking to steer clear of the global economic headwinds?

Challenges ahead

Among the major export barriers, the level of the New Zealand (NZ) dollar is the cause of greatest concern for over one-third of Kiwi exporters surveyed as part of the report.

Fluctuating currency levels create repercussions on businesses. A lower NZ dollar makes New Zealand’s exports attractive — the weakening currency, which hit a four-year low in August, works in the exporters’ favor to drive down costs.

Likewise, a stronger dollar puts exporters at a disadvantage when pit against the increased international competition over the last year, shared Mark Foy, Country Manager, DHL Express New Zealand.

Keeping prices competitive has piled on significant pressure on exporters, with “concern about increasing costs in New Zealand due to upcoming industrial regulation” highlighted by Kiwi businesses as the second major barrier to exporting.

Top 8 major export barriers

Top 8 major export barriers

- Level of NZ dollar

- Concern about increasing costs in NZ due to coming industrial regulation

- Strength of competition – Overseas markets

- Finding partners or agents in a new destination

- Managing transport and logistics

- Set up costs to develop new markets

- High tariffs due to lack of trade agreements

- Concern about an escalating trade war internationally

“There remain strong concerns with staying competitive in the face of increasing industrial relations costs, which weighs on small to medium-sized firms when they make export decisions,” said Catherine Beard, Executive Director of ExportNZ.

Adding on to the complexity is the uncertainty brought about by the trade war which has already weighed on global growth.

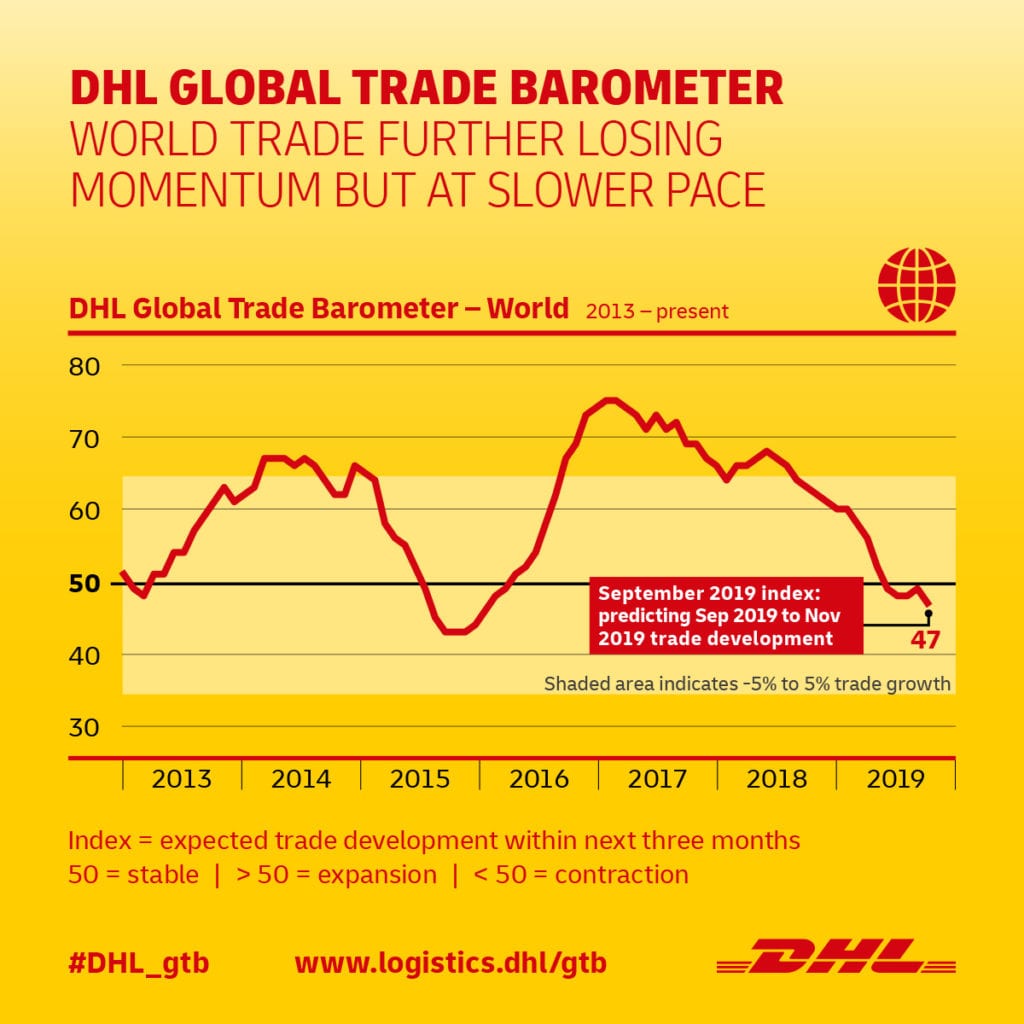

According to the DHL Global Trade Barometer, a growth index that provides an early indicator of the trade outlook based on key import and export data, the global trade outlook continues to show signs of losing momentum in the last quarter.

With no end in sight for the U.S.-China trade war, Kiwi exporters operating in the global marketplace will likely feel the impact of the trade tensions sooner or later.

Even though the IMF predicts positive economic growth for New Zealand in its latest outlook, experts are skeptical about the forecast.

Economist Shamubeel Eaqub, for instance, pointed to a quarterly survey by independent think-tank New Zealand Institute of Economic Research (NZIER) which revealed the lowest level of business confidence in New Zealand since 2009.

Way forward

Despite the tough conditions, optimism is rife among Kiwi exporters, with a majority 61 percent expecting an increase in international orders next year.

“This year’s results highlight that Kiwi exporters should prepare for any challenges ahead, but it is pleasing to see Kiwi businesses remaining confident for the coming year,” said Foy.

To stay competitive, many businesses have undertaken initiatives to boost export orders with varying degrees of success.

The most impactful, as identified in the export barometer, has been the development of new products and services followed by the enhancement of the business’ online presence, which saw a 4 percent increase from last year to 23 percent in 2019.

Making up the remaining of the top five initiatives are additional resource allocation for export activities, entry to new markets, and investments in sales and marketing.

“The number of New Zealand exporters investing in innovation, new product development and sustainable initiatives to reach international audiences is a testament to our exporting community here in New Zealand and the reason why the rest of the world will always want our Kiwi goods,” added Foy.

100% Pure New Zealand

100% Pure New Zealand

Of all the Kiwi exporters interviewed in the 2019 ExportNZ DHL Export Barometer, 49 percent of New Zealand businesses have made a conscious effort to make a positive impact on the environment, such as through the implementation of recyclable/biodegradable packaging, managing waste and utilizing electric vehicles.

The government also performs a crucial role in sustaining a favorable standing for Kiwi exporters internationally. In fact, most businesses are counting on the government’s assistance to accelerate and support their growth globally.

Attending trade shows with businesses and providing them with the necessary expertise to navigate new overseas markets should be prioritized, according to the businesses surveyed.

Meanwhile, to mitigate any potential impact from the trade war, businesses are hopeful that the government negotiates new free trade agreements that will help alleviate tariff costs and enable access to new markets.

The proposed Regional Comprehensive Economic Partnership (RCEP), for example, could represent a massive opportunity for Kiwi exporters. Once ratified, the agreement will see New Zealand become part of the world’s largest free trade zone alongside the Association of Southeast Asian Nations (ASEAN) as well as Australia, China, India, Japan, and South Korea.

Not only would this shield the country’s businesses against worsening trade woes, but it would also uplift New Zealand’s economy and unleash the potential of Kiwi exports in the future.

MORE FROM THIS COLLECTION

English

English